Many people think of tax planning as the exclusive concern of wealthy individuals trying to avoid significant tax bills, but tax considerations should be part of any comprehensive retirement plan.

One way in which tax strategy comes into play for everyday savers is tax deferral. Understanding how and where tax deferral fits into your retirement strategy is key to ensuring your investments grow for you throughout your retirement-planning journey so you will have enough money saved when you leave the workforce.

When you place your money into taxable investment accounts, such as brokerage accounts, bank accounts, or money market mutual funds, you’re hoping your money increases in value over time through the power of compounding returns and interest. However, you’re responsible for paying a yearly tax bill on interest, dividends, or capital gains. Over time, those annual tax bills can create significant tax “drag” on the growth of your money.

Tax deferral, simply put, postpones the payment of taxes on asset growth until a later date — meaning 100% of the growth is compounded and won’t be taxed until you withdraw the money, usually at age 59½ or later, depending on the type of account or contract. Ideally, you won’t need to withdraw funds until retirement, when many people find they are in a lower tax bracket and have a smaller tax obligation than they had during their working years. Moreover, waiting until you are eligible to make withdrawals allows you to avoid penalties associated with most early distributions.

Types of Tax-deferred Accounts

Tax-deferred accounts include employer-sponsored retirement plans, such as 401(k)s and 457 and 403(b) plans, as well as traditional individual retirement accounts (IRAs). Money contributed to employer-sponsored 401(k), 457, and 403(b) accounts is excluded from income taxation at the time of deposit and then taxed as ordinary income at the time of withdrawal. Similarly, contributions to a traditional IRA are deductible on your income taxes up to the limits established by the Internal Revenue Service. You can also purchase a tax-deferred annuity, a type of insurance product from which you elect when to withdraw funds. The IRS requires you to begin taking Required Minimum Distributions annually from a traditional IRA, 401(k), 403(b), or 457 account or annuity no later than April 1st of the year following the year in which you reach age 73.2

The tax benefits allow for greater investment flexibility, too, since you don’t have to worry about paying taxes on the sale of stock or other investments within the tax-deferred account.

Many people think of tax planning as the exclusive concern of wealthy individuals trying to avoid significant tax bills, but tax considerations should be part of any comprehensive retirement plan. One way in which tax strategy comes into play for everyday savers is tax deferral. Understanding how and where tax deferral fits into your retirement strategy is key to ensuring your investments grow for you throughout your retirement-planning journey so you will have enough money saved when you leave the workforce.

Financial Impact of Tax Deferral

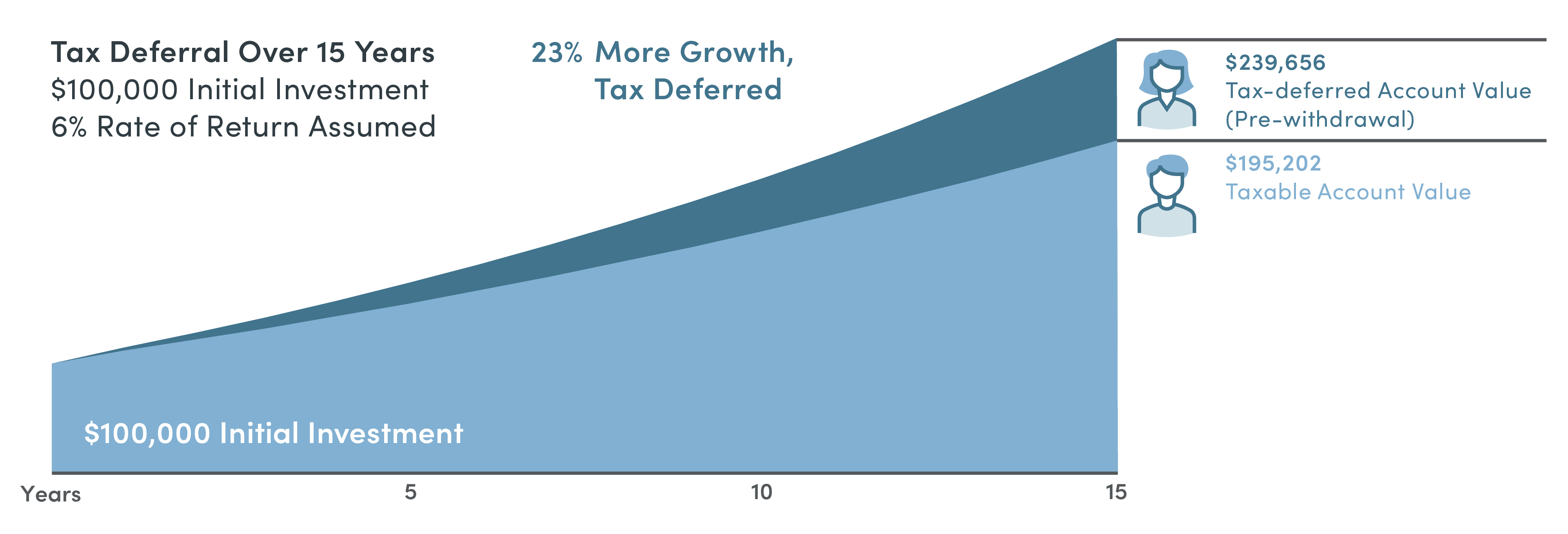

So how do the advantages of tax deferral translate in dollar terms? Consider the following hypothetical scenario. Joe invests $100,000 in a taxable account. Jane invests the same amount of money in a tax-deferred account. Assume in this example both accounts earn an annual rate of return of 6%. Each year, Joe must pay taxes on his gains, while Jane is able to leave in her account the money that would have been paid in taxes to the IRS. Over the course of 15 years, Jane’s tax-deferred account will have grown by nearly $45,000 more than Joe’s taxable account.

The bottom line: Harnessing the power of tax deferral can have a significant impact on how much your savings can grow over time. Talk to your financial professional to better understand how tax deferral can work for you.

This hypothetical example assumes a 24% overall tax rate for both Jane and Joe. This hypothetical tax-deferred investment does not reflect deduction of any fees associated with the investment product to which contributions are directed. It is important to note that while taxes on amounts invested in tax-deferred investments are deferred until withdrawn, withdrawals are subject to ordinary income tax and, if made prior to age 59½, may be subject to a 10% IRS penalty tax.

Conversely, earnings from investments that do not offer tax deferral are taxed currently, and withdrawals from such an investment are not subject to the penalty tax. Some situations such as your personal investment horizon and income tax brackets (both current and anticipated), changes in tax rates and tax treatment of investment earnings, and lower maximum tax rates on capital gains and dividends may impact the results of this comparison. Each person’s situation is different so these and other considerations must be taken into account when making an investment decision. For illustrative purposes, a tax rate of 24% has been used; however a person’s tax rate will likely change over time.

Back to Tax Center Home Tax Center

1Withdrawals are subject to ordinary income tax and, if made before age 59½, may be subject to a 10% penalty tax.

2An annuity purchased as an IRA or other qualified retirement vehicle does not receive any additional tax benefit and should be purchased based on other features such as guaranteed income and death benefits.

Download PDF Now

Download PDF Now