The EliteDesigns II Fixed Period Annuity Option is intended to lessen your initial tax burden by spreading out the gains in your annuity over time so you are only taxed on a portion of your gains each year.

Typical withdrawals from an annuity come first from an annuity’s gains, which are taxed, and then from an annuity’s cost basis (after-tax dollars used to purchase the annuity contract), which is not taxed. This means an annuity owner typically incurs a large initial tax burden that decreases over time as he or she receives payments. With the EliteDesigns II Fixed Period Annuity Option, your payment is comprised of a portion of your cost basis (non-taxable) and a portion of the annuity’s gains (taxable).1 This spreads out the income tax on your annuity payments over a period of time.2

Keep in mind that this option may not be appropriate for every person or provide beneficial tax treatment in every situation.

EliteDesigns II Fixed Period Annuity Option Features

|

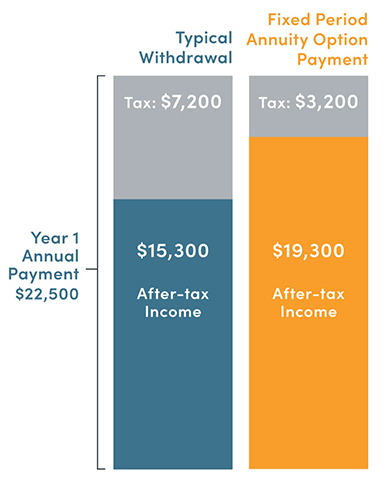

Below, we show a hypothetical example of what a first year’s after-tax payment could be with and without the Fixed Period Annuity Option.

| Hypothetical Fixed Period Annuity Option Assumptions | |

| Cost Basis (tax-free: after-tax dollars used to purchase the contract) |

$250,000 |

| Gain (taxable: earnings from the underlying investments in the contract) | $200,000 |

| Contract Value | $450,000 |

| Fixed Period | 20 Years |

| Year One Annual Annuity Payment ($450,000 ÷ 20 years) | $22,500 |

| Federal Income Tax Rate | 32% |

|

|

|

|||||||||||||||||||||||||||

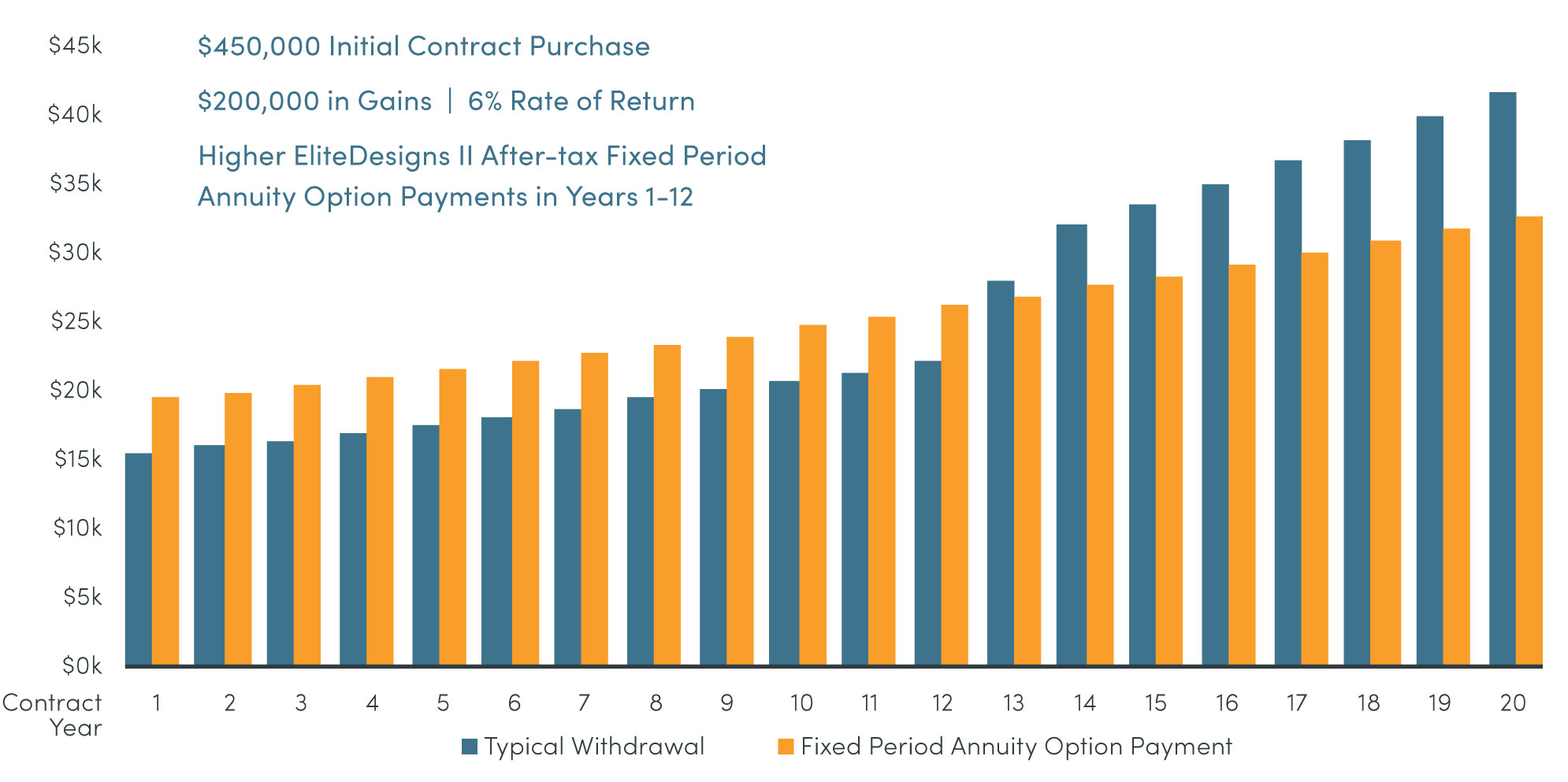

In the example below, we take the same assumptions from our previous example and extend them over a fixed period of 20 years. Because the Contract Value has the potential for growth (a hypothetical 6% rate of return is shown), each year’s payment may also increase based on your Contract Value and the time remaining in your payment period. In this case, the EliteDesigns II Fixed Period Annuity Option after-tax payment would be higher than the typical after-tax withdrawal for the first 12 years, and cumulatively, nearly $37,000 higher for the first 15 years.

| Cumulative After-tax Payments | ||

|

Typical Withdrawal |

EliteDesigns II Fixed Period Annuity Option Payment | |

| After 5 Years | $81,921 | $101,921 |

| After 10 Years | $178,854 | $218,854 |

| After 15 Years | $315,882 | $353,549 |

| After 20 Years | $509,260 | $509,260 |

The chart above assumes a 32% federal income tax rate and a hypothetical investment scenario with a 6% gross rate of return (3.42% net of an EliteDesigns II fee of 1.20%; an average administration charge of 0.25%; and an average fund expense of 1.13%). This example does not take into account any state income taxes. The example assumes withdrawals are taken after age 59½. With a 0% return, at time of the first payment, the Contract Value would be equal to $427,500. After the 10th payment, the Contract Value would be equal to $178,103. This example is hypothetical and does not project performance. This example demonstrates how the performance of the underlying funds may affect Contract Values. The actual tax impact of annuity payments will be based upon: (1) the increase or decrease in your Contract Value based on the performance of the underlying funds selected by you; (2) your actual Contract Value when payments start; (3) the actual cost basis in your annuity as of the date payments start; (4) the actual federal tax rate applicable to you in the year any payment is received and your applicable state and local taxes, if applicable; and (5) the actual tax laws and regulations applicable at the time you receive payments.

1A combination of adverse investment performance, additional withdrawals and contract fees may reduce the payout amount. Keep in mind this is one of a number of annuity options available under the EliteDesigns Variable Annuity. You should discuss with your financial professional which annuity option may be best for your financial situation.

2This example does not discuss all tax consequences applicable to receipt of payments under the EliteDesigns II Variable Annuity. Please consult your own tax advisor regarding your personal situation and the applicable tax consequences of purchasing, owning, and receiving payments under the EliteDesigns II Fixed Period Non-life Annuity Option.

3The excludable (non-taxable) amount is determined by dividing the cost basis of $250,000 by the fixed period of 20 years, which equals $12,500. This excludable amount is subtracted from the total payment amount before the tax rate is applied. The payment of $22,500, reduced by $12,500 equals $10,000, the amount to which the 32% tax rate is applied. This example does not reflect any state income taxes and assumes withdrawals begin after age 59 ½.

Download PDF Now

Download PDF Now